Home > FAQs

FAQs - Investing in Indonesia

Indonesia is the fourth most populous country in the world with young work force and a large and growing domestic market due to the demographic bonus, making Indonesia one of the world's leading economies.

Despite heightened global uncertainty, Indonesia’s economic outlook continues to be positive, with domestic demand being the main driver of growth. Supported by robust investment, stable inflation, and a strong job market, Indonesia’s economic growth is forecast to reach 5.2% in 2020.

As the only G-20 member in Southeast Asia and an active voice to develop world concerns, Indonesia plays a more significant role in the global stage. Standard Chartered foresees Indonesia's entry into the G-7 by 2030, and projects that the Indonesian economy could become the 10th largest by 2020 and the 5th largest by 2030.

Being the world’s 3rd largest flourishing democracy with the largest Muslim populations, Indonesia has a stable policy situation with high commitment to implement structural reforms. Worldwide Governance Indicators Survey conducted by World Bank indicated that Indonesia has improvements in several indicators such as Government Effectiveness, Regulatory Quality, and Control of Corruption.

Indonesia has progressed in Ease of Doing Business over the past few years, with rank of 73 among 190 economies in ease of doing business 2019. In addition to that, Indonesia has leaped to the fourth place, from previously on the eight place, as a prospective investment destination 2017-2019 based on the survey of the United Nations Conference on Trade and Development (UNCTAD).

Indonesia has abundant of natural resources. It also has the second highest biodiversity level in the world after Brazil. Aside from the flora and fauna, Indonesia is a home to many ecosystems. From beaches, small islands, coral reefs, seaweed beds, sand dunes, tidal flats, coastal mud, mangroves and others make Indonesia the most attractive place for investment especially in the tourism sector.

- Three of four US companies in Indonesia plan to expand their business (AmCham’s and US Chamber of Commerce’s survey, 2017).

- Indonesia still becomes main investment destinations in APEC region, together with Vietnam and China (PwC’s APEC CEOs survey, 2017).

- Indonesia is the fifth most promising country for overseas business (Japan Bank for International Cooperation’s survey, 2017).

- Indonesia becomes priority for investment country in Asia, following China. And also has the highest confidence of positive reforms (The Economist’s Asia Business Outlook Survey 2017).

- Indonesia ranked fourth as the most prospective country for investment by MNEs in 2017-2019, after the US, China and India (UNCTAD Business Survey 2017).

- Indonesia was named Top Reformer in Asia for reforming its Ease of Doing Business (World Bank’s 2018 survey).

- Indonesia is one of the most attractive investment destinations in Asia due to strong consumer demand and its improvements on investment and business climate (Economist Corporate Network survey, 2017).

- Indonesia’s growth (GDP) is estimated to remain strong among other countries. Its GDP is also predicted to rise to 5.4 percent in 2018 and 5.5 percent in 2019 from 5.1 percent in 2017. In addition,Indonesia’s Long Term Foreign and Local Currency Issuer Default Rating has increased to BBB from the previous BBB- with a stable outlook (Fitch Ratings, 2018).

- Indonesia has a big economy and business opportunities as it named as Top-20 largest GDP current price, worth over USD 1.015 in 2017 (IMF, 2018) and has been included in the trillion-dollar club, countries with GDP more than USD 1 trillion per year (SEASIA, 2017).

The challenges with Indonesian infrastructure have a lot to do with the geographical realities in the country, as a vast archipelago. The fiscal budget allocated for infrastructure increased more than doubled in the last five years and private sector’s contribution is strongly encouraged and facilitated.

The Government has issued several policies, including the provision of government guarantees, land acquisition for development projects, and viability gap fund for part of PublicPrivate Partnerships or PPP (Kemitraan Pemerintah dan Badan Usaha or KPBU) project’s construction cost. In addition, the government established some financial institutions to help finance PPP projects and increase their bankability.

President Joko Widodo has set an infrastructure target in the five-year development plan, to be achieved by 2019. Indonesia, among others, will build 15 new airports, increase the capacity of 24 seaports, add 60% to current railway tracks, construct 1,000 km of toll roads, as well as provide 35,000 megawatts of power.

FAQs ON PRIORITY SECTORS

These priorities sector was selected based on the economic advantages, growth factors and productivity aspects. The sectors are as follows:

Most industries and other business fields in Indonesia are open for foreign investments unless mentioned otherwise in the Investment Guidance or previously called the “negative investment list or DNI”. This regulation attaches to the Investment Law under Presidential Regulation No. 44 Year 2016

Investment together with manufacturing industry and export are expected to be the pillars of Indonesian economy. There are three aspects where investments shall contribute the most to the economy.

First, supporting sustainable economic growth. We seek quality investments, that do not only see Indonesia as a market, but also as a production base. Investments that add value to our natural resources, contribute to our export and substitute our import. We also seek responsible investments that considering environmental and social factors to embrace long term benefit.

Second, creating jobs, improving productivity and competitiveness. Investment in manufacturing sectors is prioritized, especially labor-intensive industry, export-oriented and import-substitution industry, and also downstream industry of natural resources.

Third, promoting equal development distribution. We encourage more investments realized outside Java Island, the most populated island in Indonesia. We offer more incentives especially to investments located in eastern part of Indonesia, such as Nusa Tenggara, Maluku, and Papua.

FAQs ON SPECIAL ECONOMIC ZONES

Currently, there are 15 Special Economic Zones (SEZ) in Indonesia. Each of SEZs is developed for specific sectors. The existing SEZs are:

- Tanjung Lesung SEZ in Banten Province, for tourism (already operated in February 2015).

- Sei Mangkei SEZ in North Sumatera Pryearovince, for CPO and rubber industry, fertilizer industry,logistics, and tourism (already operated in December 2016).

- Mandalika SEZ in West Nusa Tenggara Province, for tourism (already operated in September 2017).

- Palu SEZ in Center of Sulawesi Province, for smelters, agro industry, and logistics (already operated in September 2017).

- Tanjung Api-Api SEZ in South Sumatera Province, for Crude Palm Oil, rubber downstream industry, and petrochemical industry (already operated in June 2018).

- Arun Lhokseumawe SEZ in Aceh Province, for oil and gas industry, petrochemical, agro industry,logistics, and paper industry (already operated in December 2018).

- Galang Batang SEZ in Riau Island Province, for mineral processing industry, energy, and logistics (already operated in December 2018).

- Tanjung Kelayang SEZ in Bangka Belitung Island Province, for tourism (already operated in March 2019). I. Maloy Batuta SEZ in East Kalimantan Province, for CPO, wood, coal, and mineral industry (already operated in April 2019).

- Bitung SEZ in North Sulawesi Province, for fishery and agro industry, and logistics (already operated in April 2019). K. Morotai SEZ in Maluku Province, for tourism, manufacturing industry, and logistics (already operated in April 2019).

- Sorong SEZ in West Papua Province, for tourism, industrial shipyards, fisheries processing industry, mining industry, and logistics (already operated in October 2019).

- Singhasari SEZ in East Java, for tourism, creative industry (under development).

- Kendal SEZ in Central Java, for manufacturing industry, textile industry, logistic (under development).

- Likupang SEZ in North Sulawesi, for tourism (under development).

FAQs ON STARTING BUSINESS

To establish a foreign direct investment company in Indonesia you must first decide what business sector you are going to invest based on Klasifikasi Baku Lapangan Usaha Indonesia “KBLI” (Indonesian Classification for Business Sector). Then, you must check whether the business sector is open with requirements or closed for foreign direct investment based on the Presidential Regulation No. 44 Year 2016 about “DNI” (Negative Investment List). If the business sector which you are interested in is not regulated, and no other restrictions from related technical ministries, then it means the business sector is open for foreign direct investment with a maximum foreign ownership of 100%. The legal entity of the FDI Company should be a Limited Liability Company or Ltd. Perseroan Terbatas or PT.The ‘PT’ company should be owned by minimum 2 shareholders. Those can be individual or corporate shareholders or combination of both.

The minimum investment for an FDI company is above IDR 10 billion (excluding land and building cost), while the minimum paid up and issued capital is IDR 2.5 billion. For each shareholder, at least IDR 10 million or its equivalent in USD is required.

Yes, you can set up a company in any part of Indonesia. However, there are restrictions for some business sectors in certain regions, Industrial Law No. 3 Year 2014 and Government Regulation No. 142 Year 2015 has mandated that any industrial activities shall be located in industrial estates. Today, the Indonesian Industrial Estates Association (Himpunan Kawasan Industri Indonesia or HKI) has 87 company members, in 18 provinces, covering total gross area of about 86,059 hectares. There are more than 9,950 manufacturing companies operating and these figures do not include industrial estates non HKI members. Main attractions of industrial estates are that the development is comprehensively planned to assure a strategic location, accessibility, building ratio, infrastructure and supporting services, secured land titles, and continuous maintenance and operation management, as well as integrated enviromental management.

The process of company establishment in Indonesia requires Investor to issue Article of Association and legalization of the company, including Taxpayer identification number (NPWP), through Public Notary.

Foreign investor could set up a Representative Office to study the market. Foreign Representative Office “KPPA” is an office incorporated by an overseas company to represent themselves in Indonesia. Foreign Representative Office usually has limited functionalities and are generally prohibited from directly engaging in operational activities, signing contracts, issuing official invoices, receiving payments from its clients, and directly engaging in any other profit generating activities. The requirement and procedure to form a representative office in Indonesia are governed by BKPM Regulation No. 6 Year 2018 as amended by BKPM Regulation No. 5 Year 2019 regarding Procedures and Guidelines for Licensing and Investment Facility. To obtain the Representative Office license, all requirements should be submitted online at Online Single Submission (OSS) system. The functionality of KPPA is limited to: A. Manage the parent company’s corporate interests. B. Prepare the establishment and development of its business in Indonesia. Important Notes for KPPA: A. KPPA can only be incorporated in capital of Indonesian provinces (e.g. Jakarta, Bandung, Surabaya, Medan Denpasar, etc.). B. The location of KPPA must be in office building.

The regulation of Central Bank of Indonesia stated that all banking transactions (such as capital injections, administration of loans, payment of capital equipment, raw materials and others) of a newly established PT. PMA should be administered through a special foreign investment bank account in Indonesia. The required documents to open such account are as follows:

- Registration Number (NIB), the Deed of Establishment, Company Domicile Certificate (Surat Keterangan Domisili Perusahaan or SKDP), Taxpayer identification number (NPWP).

- The power of attorney, specifically required for person who is authorized to open the bank account.

- Citizen Identification Card (KTP) or passport of the authorized person to open the bank account.

- Photograph of the authorized person to open the bank account.

- Minimum deposit of IDR 10 million or USD 1,000.

FAQs ON GETTING LICENSES

Basically, to start a business in Indonesia, the company should obtain following licenses:

- Single Business Number “NIB”

- Business License “Izin Usaha”

- Commercial/Operational License “Izin Komersial/Operasional”

These licenses can be processed through Online Single Submission (OSS) system (www.oss.go.id), an online system created by the Government of Indonesia to simplify the application of business license and other permits. All new and existing individuals or business entities (include MSMEs), and representative offices can get their business licenses through the OSS system.

Yes, there are. The guidelines are available in Bahasa Indonesia, and can be found on the OSS website (www. oss.go.id) in Informasi’s sub-section, ‘Petunjuk Teknis Pengisian’.

Procedure to get a business license:

- Businesses register through the OSS system.

- The OSS system will issue Business Identification Number (NIB), Business License, Location Permit, Environmental Permit, and Commercial/Operational License.

- Businesses fulfil the commitments of licenses and permits required by technical ministries/agencies and regional governments.

- Businesses make the required payments of Non-Tax State Revenue (PNBP) or regional levies.

- Licenses issued by the OSS system will be activated.

Business licenses can be applied online through OSS except for several sectors. The excluded sectors are finance, mining (oil and gas, mineral and coal, and geothermal), and property. For these sectors, licenses can be applied through One Stop Service Center (Pelayanan Terpadu Satu Pintu or PTSP Pusat) BKPM.

Regarding the sectoral business licenses, PTSP Pusat has 3 types of services, they are:

- Self Service

- Assistance Service

- Priority Service

Other than that, PTSP Pusat also provides consultation and complaint services.

PTSP Pusat at BKPM is established to provide a simple, faster, transparent and integrated service for starting business in Indonesia. At PTSP Pusat, there are Representative Officers from 22 ministries and government institutions that provide consultation and accept application for business licenses which are not included in the OSS.

One Stop Service Center (PTSP Pusat) in BKPM offers activities such as:

- Serving information and consultation on investment policies in a specific sector.

- Serving business license applications which are not regulated in Government Regulation Number 24 Year 2018 regarding Online Integrated Business Licensing Service.

- Clarifying the procedure of business licensing application through the OSS system (Layanan Berbantuan).

- Facilitating the problems faced by investors in realizing their investment in Indonesia.

- Synchronizing and coordinating with related Ministries/Institutions including with provincial, regency/ city governments, administrators of Special Economic Zones (SEZs), and Free Zone Authority.

- Providing priority service for eligible investors in obtaining business licenses (Layanan Prioritas).

FAQs ON PRIORITY SERVICE

Priority Service or “Layanan Prioritas” is a service provided for eligible investors who meet requirements.

Through Priority Service, investors will obtain:

- Deed of establishment of the company

- Legalization from the Ministry of Law and Human Rights

- Taxpayer identification number “NPWP”

- Single Business Number “NIB”, which also function as: Company Registration Number “TDP”, Importers Identification Number “API”, and Custom Access “Akses Kepabeanan”

- Foreign Workers Utilization Plan “RPTKA” for workers (outside shareholders) 3-Hour Energy and Mineral Resources (ESDM)

8 Types of licenses :

- Temporary Business License for Oil/ Fuel/LPG Storage

- Temporary Business License for Storage of Processed Products/CNG

- Temporary Business License for LNG Storage

- Temporary Business License for Oil Refinery

- Temporary Business License for Processing Oil Residue Industry

- Temporary Business License for Natural Gas Processing

- Temporary Business License for General Trade of Oil/Fuel

- Temporary Business License for General Trade of Processed Products

The requirement to get this service are:

- Planned value of investment at least IDR 100 billion, and/or absorbing at least 1,000 local workers.

- The investor come in person to PTSP Pusat at BKPM, and if a candidate of shareholder represents other shareholders, he/she has to bring the letter of authorization.

The exemption from the above criteria is valid for:

- Certain manufacturing lines of business, or be domiciled in certain areas that fall under an inland free trade arrangement in accordance with the prevailing regulations.

- Certain manufacturing lines of business that are part of a supply chain, by showing Statement Letter or MoU as a supplier for company who will use the products.

- Companies will be domiciled in a Special Economic Zone.

- Companies participate in tax amnesty programs, by showing evidence of the tax amnesty submission receipt issued by the Minister of Finance or the relevant appointed official.

Priority Service for ESDM Sector: No requirements

FAQs ON INVESTMENT INCENTIVES

Yes. Indonesian Government provides investment incentives as follows:

BKPM Regulation No. 6 Year 2018 as amended by BKPM Regulation No. 5 Year 2019 and Ministry of Finance Regulation No. 176/PMK.011/2009 as amended by Ministry of Finance Regulation No. 188/ PMK.010/2015, explained:

All of FDI and Domestic Direct Investment or DDI (Penanaman Modal Dalam Negeri or PMDN) projects which are issued by the OSS system will be granted the exemption of Import Duty, with the final tariffs become 0% (zero percent). This facility would be applicable on:

- The importation of capital goods namely machinery, equipment, and auxiliary equipment for an import period of 2 years, started from the date of stipulation decisions on import duty relief.

- The importation of goods and materials or raw materials regardless of their types and composition, which are used as materials or components to produce finished goods or to produce services for the purpose of 2 years full production (accumulated production time).

- The importation to the extent of machines, goods and materials which:

- Are not produced in Indonesia

- Are produced in Indonesia but they don’t meet the required specifications

- Are produced in Indonesia but the quantity is not sufficient for the need of the industry

According to the Regulation of Minister of Finance No. 66/ PMK.010/2015, the exemption of import duty will also be granted to the importation of capital goods of electricity for an import period of 2 years and can be extended by a maximum 1 year. This facility is not applicable for transmission, distribution, supporting services and repairing equipment.

As stated in the Regulation of Minister of Finance No. 259/ PMK.04/2016, the importation of goods in term of Contract of Work or CoW (Kontrak Karya or KK) or Coal Mining Business Work Agreement (Perjanjian Karya Pengusahaan Pertambangan Batubara or PKP2B) will be granted the exemption and/ or relief from import duty based on the owned contract. The application can be requested by attaching recommendation letters from Directorate General of Mineral and Coal, Ministry of Energy and Mineral Resources of the Republic of Indonesia.

Tax Allowance based on Government Regulation No.78 Year 2019, regarding to Income Tax Facilities for Capital Investment in Certain Business Fields and/or in Certain Regions, the domestic and foreign investors will be granted for tax allowances in certain business fields and/or regions.

Facilities provided by the Government Regulation No. 78 Year 2019 are:

- Reduction of net income by 30% of the total investment in the form of tangible fixed assets, including any land used for the business main activities, shall be charged for 6 years, respectively of 5% per year calculated from the commencement of commercial production.

- Accelerated depreciation on tangible assets and amortization of intangible assets acquired in the framework of investment.

- The imposition of income tax on dividends paid to any non-resident taxpayer other than a permanent establishment in Indonesia.

- Loss compensation for more than 5 years but not more than 10 years, for:

- Company located in Industrial Area and/or Bonded Zone;

- Company operating in renewable energy sector; - Company issuing the cost for the economic and/or social infrastructure in business location at the least of 10 billion rupiah;

- Company using materials and/ or domestic result component at least 70% since the second year;

- Company hiring at least 300 or 600 Indonesian workforces for 4 consecutive years;

- Company issuing the cost of domestic research and development in order to product development or production efficiency at least 5% from the total capital investment for 5 years period;

- Company undertaking export at least 30% from the sales total value, for the capital investment in certain business fields that are carried out outside of the bonded zone.

For detailed information on the list of business sectors that are eligible for Tax Allowance, please refer to the Attachment I & II of Government Regulation No. 78 Year 2019. There are 166 business fields listed in Attachment I and 17 business fields listed in Attachment II.

Note: The application and provision for tax allowance will be carried out online through the OSS system.

According to the Regulation of Minister of Finance No. 150/PMK. 010/2018 and the Regulation of BKPM No. 1 Year 2019 as amended by Regulation of BKPM No. 6 Year 2019, reduction in Corporate Income Tax (Tax Holiday) is given at 100% (one hundred percent) of the amount of the Corporate Income Tax owed with minimum new investment IDR 500 billion and at 50% (fifty percent) with minimum new investment between IDR 100 billion – IDR 499 billion.

The applicant or company should meet the following criteria:

- The Pioneer Industry:

- upstream base metal industry (iron and steel or non-iron and steel) without or with their integrated derivatives;

- oil and natural gas purification or refining industry without or with their integrated derivatives;

- petroleum-based petrochemical, natural gas or coal industry without or with their integrated derivatives;

- industry of basic organic chemicals sourced from agricultural, plantation, or forestry without or with their integrated derivatives;

- industry of basic inorganic chemicals without or with their integrated derivatives;

- industry of main raw materials of pharmaceutical without or with their integrated derivatives;

- irradiation, electro-medical, or electrotherapy equipment manufacturing industry;

- manufacturing industry of main components of electronics or telematics devices, such as semiconductor wafers, backlight for Liquid Crystal Display (LCD), electrical driver, or display;

- machinery and machinery main components manufacturing industry;

- industry of robotic components that supports machines manufacturing industry,

- power plant main components manufacturing industry;

- motor vehicle and motor vehicle main components manufacturing industry;

- vessel main components manufacturing industry;

- train main components manufacturing industry;

- industry of aircraft main components and aerospace industry supporting activities;

- agricultural, plantations, or forest product-based processing industry producing pulp without or with their derivatives;

- economic infrastructure; or

- digital economic which includes data processing, hosting, and activities associated with them.

- Having status as Indonesian Private/Public Company

- Having a value of the new investment plan of at least IDR 100,000,000,000 (one hundred billion rupiahs);

- Having not yet been issued a decision regarding the granting of a notification or concerning the refusal to reduce the Corporate Income Tax by the Minister of Finance.

- Fulfill the provisions of the amount of the ratio between debt and capital as referred to in the Regulation of the Minister of Finance concerning determining the amount of the ratio between debt and company capital for the purposes of calculating Income Tax;

The period of the reduction is provided with the following conditions:

- 5 (five) tax years for new investment with a value of investment plan of at least IDR 500,000,000,000 (five hundred billion rupiahs and a maximum of less than IDR 1,000,000,000,000 (one trillion rupiahs);

- 7 (seven) tax years for new investments with an investment plan value of at least IDR 1,000,000,000,000 (one trillion rupiahs) and a maximum of less than IDR 5,000,000,000,000 (five trillion rupiahs);

- 10 (ten) tax years for new investments with an investment plan value of at least IDR 5,000,000,000,000 (five trillion rupiahs) and maximum of less than IDR 15,000,000,000,000 (fifteen trillion rupiahs);

- 15 (fifteen) tax years for new investments with an investments plan value of at least IDR 15,000,000,000,000 (fifteen trillion rupiahs) and no more than IDR 30,000,000,000,000 (thirty trillion rupiahs);

- 20 (twenty) tax years for new investments with the value of the investment plan at least IDR 30,000,000,000,000 (thirty trillion rupiahs).

Note: BKPM will publish “In Advance Confirmation” which is a notification letter to investors regarding the fulfilment of the requirements of the pioneer industry to obtain a corporate income tax deduction facility for the investors who applied for it.

List of business fields (Indonesia Standard Industrial Classification-KBLI) of the pioneer industry can be seen in the Attachment of the BKPM Regulation No. 6 Year 2019.

GREEN LANE

Starting 2016, the government accelerates custom clearance process for imported capital goods, aiming at speeding up project under construction. Capital goods no longer need screening at the ports. So, it will cut the processing time from five days to only 30 minutes.

WAGE FORMULA

Since September 2015, Indonesian government has issued several economic policy packages, among others, to improve investment climate. We set a minimum wage formula so investors can predict annual increase of wage, considering inflation and economic growth.

OTHERS

We support business to reduce their production costs by cutting the price of fuel, gas, and electricity for industry. We revised the Negative Investment List (DNI) to be more open for foreign investment, specifically intended for industrial, creative economy, and tourism sectors.

FAQs ON LABOR

In Indonesia, minimum wage is a monthly wage payable to labor. It mainly consists of fixed basic wage that is stipulated by regional governors as a safety net.

The latest Government Regulation No. 78 Year 2015 regarding Wages (GR 78) introduces several important changes, notably those concerning the calculation of provincial minimum wages and the requirement that all employees in Indonesia be paid in Rupiah.

The main points of GR 78 are:

- Minimum wage calculation in GR 78 introduces a new formula for provinces to calculate their minimum wage each year, beginning in 2016. The introduction of the formula should bring certainty to the annual calculation of minimum wage and help create a more reliable business climate.

The new formula is as follows:

New minimum wage = current minimum wage + (current wage x (Inflation + % GDP annual increase during the year) - Wages must be paid in Rupiah The Article 21 of GR 78 requires that wages for all employees be paid in Indonesian Rupiah and does not differentiate between foreign and local employees.

Wage scale and structure in GR 78 requires employers to prepare a wage scale and structure for employees by taking into consideration the group, positions, years of service, education, and competence of employees. Employers must inform employees of this wage scale and structure, and GR 78 requires that a copy of the wage scale and structure be attached to company regulation registration or renewal applications.

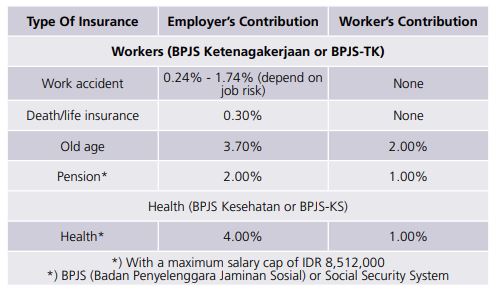

Yes, based on Law of the Republic Indonesia No. 24 Year 2011, employer will have to contribute a certain share based on employee monthly wage into the social security programme. The programme will provide economic assurance for every employee’s wellbeing. The new Social Security Agency for Workers and/or Health (Badan Penyelenggara Jaminan Sosial untuk Ketenagakerjaan dan/atau Kesehatan or BPJS-TK and BPJS-KS) will continue to ensure that employer takes part in the mandatory social security programmes such as Pension Guarantee, Life Insurance, and Work Accident Insurance.

For more information on the details to social security pay-out structure, submission of application, working details, and latest updates please directly contact BPJS for Workers at http://www.bpjsketenagakerjaan.go.id/ and BPJS for Health at https://bpjskesehatan.go.id/bpjs/

Yes, in the framework of investment, foreigners are allowed to hold positions where there are no Indonesian nationals available, or do not meet the requirements and subject to the conditions that such positions are open for foreigners. Foreigners can be employed in Indonesia only for certain positions and period.

Employers of foreign workers in this shall include:

- Government body(s)

- International body(s)

- Representatives of foreign country

- International organization

- Foreign Company Representative Office (KPPA), Foreign Company Trade Representative Office (KP3A), Foreign Press Office

- Foreign private company, foreign business entity

- Legal Entity established under the Indonesian Law in form of Ltd. (PT) or foreign private organization

- Social institute and other institute for religious, education, or cultural purpose

- Impresario service entity

The employers is able to hire foreign workers only for a certain position and a certain time.

Employers of Federal Civil Firm (Firma/ Fa), the Limited/Federal Partnership (CV), Associated Business (Usaha Bersama), Trading Company (Usaha Dagang or UD) are prohibited from employing foreign workers except as provided in the Law.

According to Decree of the Minister of Manpower No. 228 Year 2019 concerning Certain Positions Open For Expatriates:

- Certain positions open for Expatriates as listed in the Appendix, which is an inseparable part of this Ministerial Decree. This regulation lists more than 2,000 job titles across 18 sectors that can now be filled by expatriates.

- The positions of Commissioners or Directors who are not managing personnel are open for Expatriates.

- The Minister or an appointed official may give approval for the employment of Expatriates in the event that the positions required by the employers are not listed in the Appendix as an inseparable part of this Ministerial Decree. According to Decree of the Minister of Manpower No. 40 Year 2012, foreigner cannot hold a position as:

- Personnel Director

- Industrial Relation Manager

- Human Resource Manager

- Personnel Development Supervisor

- Personnel Recruitment Supervisor

- Personnel Placement Supervisor

- Employee Career Development Supervisor

- Personnel Declare Administrator

- Chief Executive Officer

- Personnel and Careers Specialist

- Personnel Specialist

- Career Advisor

- Job Advisor

- Job Advisor and Counseling

- Employee Mediator

- Job Training Administrator

- Job Interviewer

- Job Analyst

- Occupational Safety Specialist

Companies employing foreigners are charged USD 100 per title per person per month (Article 23 Decree of the Minister of Manpower No. 10 Year 2018).

First of all, employer (either DDI or FDI) should submit Foreign Workers Utilization Plan (RPTKA) application to the Ministry of Manpower of the Republic of Indonesia to get approval through link http://tka-online.kemnaker. go.id.

Once approved, Ministry of Manpower of the Republic of Indonesia will issue RPTKA Endorsement to the employer.

Employee will then be able to apply for Limited Stay Visa (Visa Tinggal Terbatas or VITAS). General requirement for VITAS application as follows:

- Application letter

- Copy of bank statement

- Original passport with minimum 18 months validity for 1 year stay period or 30 months validity for 2 years staying period

- Recommendation letter: RPTKA

There are 2 options for VITAS application:

- VITAS which is submitted by the employer/ guarantor:

- The employer submits Visa application to Directorate General of Immigration.

- The employer has to pay for the telex visa approval cost.

- When the VITAS application is approved, the employer will obtain a copy of Visa Approval Letter and another copy will be sent to Indonesian Embassy/ Consulates.

- The foreign worker has to come to the Indonesian Embassy/Consulates to submit the application with a copy of the Visa Approval Letter and pay for visa fee.

- After obtaining a visa, the foreign worker will head to Indonesia, and will be granted with an Entry stamp upon arrival.

- Foreign worker should report to the local immigration office where he/ she domicile in Indonesia to take biometric and interview and also pay the limited stay permit fee.

- VITAS issued.

- VITAS which is submitted by the foreign worker:

- The foreign worker submits VITAS application to Indonesian Embassy/ Consulates.

- The foreign worker will pay for the telex visa approval cost.

- The Indonesian Embassy/ Consulates will forward the application to Directorate General of Immigration for approval.

- When the Visa application is approved, The Indonesian Embassy/ Consulates will issue the visa. The foreign worker also has to pay for the visa fee.

- After obtaining a visa, the foreign worker will head to Indonesia, and be granted with an Entry stamp upon arrival.

- Foreign worker should report to the local immigration office where he/ she domicile in Indonesia to take biometric and interview and also pay the limited stay permit fee.

- VITAS issued.

After entering Indonesia, foreign worker should report to the Immigration Office close to their area within 7 days of arrival to get the Limited Stay Permit Card (Kartu Izin Tinggal Terbatas or KITAS). The following procedures also applies to the temporary foreigner workers and expertise, such as : specialized technician for temporary repair work, some experts for short-term job position and any affiliated foreigner for specific work function.

Employers who will employ foreign worker shall have an RPTKA. RPTKA is a basis to obtain Foreign Worker Employment Permit (IMTA). In order to receive RPTKA, the employer must submit an online application to the Directorate General of Manpower Placement Development and Job Opportunity Expansion through the Director of Expatriate Worker Utilization Management by enclosing:

- Letter detailing the reason to hire foreign nationals

- Completed RPTKA form

- License from authorized ministry

- Article of Association of legal entity that has been legalized by authorized ministry

- Organizational structure of the employer company

- Letter of the employer’s domicile from regional government

- Letter of Appointment to Indonesian manpower as assistant to the foreigner and a mentoring program plan

- Letter of Statement of the capacity to provide education and training for Indonesian manpower in accordance with the qualifying position occupied by the foreign worker

- Employer Taxpayer Identification Number (NPWP)

- Copy of valid obligatory report of employment in accordance to Law of the Republic Indonesia No. 7 Year 1981

- Recommended position that will be occupied by the foreign worker from technical ministriesb (if required)

Based on Presidential Regulation No. 20 Year 2018 on Foreign Workers Utilization, companies employing foreign workers in the following positions do not need to apply for the RPTKA:

- Shareholder as a member of the Board of Directors or a member of the Board of Commissioners of the employer of TKA;

- Diplomatic and consular officers at representative offices of foreign countries; or

- TKA on the type of work required by the government.

For emergency and urgent work, the Employers of TKA may employ TKA by applying for RPTKA endorsement to the Minister or appointed official not later than 2 (two) workdays after the TKA is working.

According to the Article 42 paragraph (4) and (5) of Law of the Republic Indonesia No. 13 Year 2003 regarding on Employment, foreign worker can only be employed in Indonesia for a certain position and department.

As a follow up to the above regulation, the Ministry of Manpower Regulation No. 10 Year 2018 regarding Procedures for Licensing Hiring Foreign Workers stipulate. There are certain positions which are prohibited for foreigners.

Additionally, the employer or sponsor is prohibited from hiring foreign worker who has already working in other company with exception if the foreign worker is appointed as Director or Commissioner in other company as stated in its General Meeting of Shareholders or certain sectors such as vocational education and training, digital economic and also oil and gas.

According to Article 35 of Act of the Republic Indonesia No. 13 Year 2003 about Manpower, employer can recruit a local worker directly or through manpower placement service providers. The manpower placement service provider shall provide protection as from the recruitment to the manpower placement. The employer in employing worker shall provide protection covering welfare, safety, and physical and mental health of the worker.

There are 2 kinds of working relations between employer and employee:

- Working relation for unspecified period applied to permanent employee. The working agreement for unspecified period can require a probation period for 3 months at the maximum and the wage received by the employee shall not below the minimum wages.

- Working relation for specified period. This working relation shall be based on the period of time (maximum 3 years) and the completion of a certain job. Working agreement for specified period cannot require a probation period. It can be applied for a period of 2 years at the maximum and only could be extended maximum once for a year.

Note: Please refer to Act of the Republic of Indonesia No.13 Year 2003 for further information.

Yes, it is. Outsourcing is defined as obtaining goods or services by contract from an outside supplier. However, majority of the outsource workers are employed under temporary contract.

Related to this, there will be 2 definitions of outsourcing:

-

If outsourcing is perceived as the recruitment of workers who directly conducted by the employer with the status of working relationships are specified for certain period and unspecified period work agreement, thus this outsourcing definition is associated with the Article 56-59, Law of the Republic of Indonesia No.13 of 2003 and Decree of Minister of Manpower No.100/ MEN/VI/2004.

Specified period work agreement is for a particular job that will be completed within a specified time, which included in a category, as follows:- Job which could be done in one time or temporary

- Job which is estimated a maximum of 3 years for its completion

- Job which is seasonal

- Job which correlates with new product, new activity or additional product that are still in experiment or poll

- If outsourcing is understood as obtaining goods or services by contract from outside parties,then outsourcing in this definition must be in accordance with Decree of Minister of Manpower No.19 of 2012. Outsourcing is divided into 2 types, which are:

- Whole package service provider, must meet the conditions, as follows:

- Conducted separately from the main activity, not only management but also the implementation of work activities.

- Performed with a direct order or indirect order from the employer.

- Supporting activities that support and facilitate the main activity.

- Do not hinder production process directly.

- Worker service provider (worker only), should be a supporting service or not deal directly with the production process:

- Cleaning service

- Catering for workers

- Security

- Supporting services in oil and gas industry

- Transportation provider for workers

Yes. According to the Article 102 and 103 of Act of the Republic Indonesia No. 13 Year 2003 concerning Manpower, workers and their organizations [unions] shall perform the function of performing their jobs/ work as obliged, keeping things in order in order to ensure continued, uninterrupted production, channeling their aspirations democratically, enhancing their skills and expertise and helping promote the business of the enterprise for which they work and fight for the welfare of their members and families. Every worker has the right to form and become member of a trade/ labour union, and a trade/labour union shall have the right to collect and manage fund and be accountable for the union’s finances.

According to the Article 102 of Act of the Republic Indonesia No. 13 Year 2003 concerning Manpower, In conducting industrial relations, the government shall perform the function of establishing policies, providing services, taking control and taking actions against any violations of statutory manpower rules and regulations. In the case of industrial relations dispute, employer and labor union should resolve it first through bipartite bargaining in deliberation to reach consensus. In the event the bipartite bargaining failed, then one or both of the parties can file their dispute to the local authorized manpower offices. Further information about industrial relations dispute settlement can be referred to Act of the Republic Indonesia No. 2 Year 2004 concerning Industrial Relations Disputes Settlement.

Yes, labors strike is regulated on the Decree of Minister of Manpower No. 232 Year 2003. According to this regulation, strike is an action that is planned and performed together by workers and/or by trade unions/labor unions in order to stop or slower work. Strike is a basic right of workers and/or trade unions/labor unions that is carried out legally, orderly, and peacefully as a consequence of failed negotiations.

Failed negotiation shall refer to the reaching of no agreement to settle industrial relations disputes because the entrepreneur is unwilling to negotiate even though the trade union/labor union or the worker has submitted a written request for negotiation twice within a period of 14 (fourteen) workdays or because the negotiations lead to a deadlock and this is declared by both sides in the negotiation minutes.

The strike shall be deemed illegal if it is carried out:

- Not as a result of failed negotiations; and/or

- Without any notification given to the entrepreneur and the government agency responsible for manpower affairs; and/or

- With a notification but the notification is given less than 7 (seven) days prior to the strike; and/or

- With a notification but the contents of the notification do not accord with points of Article 140 of Law No. 13 Year 2003 concerning Manpower.

Termination of employment is regulated in Chapter XII of Law of the Republic Indonesia No. 13 Year 2003 concerning Manpower. Based on this regulation, the entrepreneur, the worker and/or the trade/labour union, and the government must make all efforts to prevent termination of employment from taking place.

If despite all efforts made termination of employment remains inevitable, then, the intention to carry out the termination of employment must be negotiated between the entrepreneur and the trade/labour union to which the affected worker belongs as member, or between the entrepreneur and the worker to be dismissed if the worker in question is not a union member.

The entrepreneur may only terminate the employment of the worker after receiving a decision [a permission to do so] from the institute for the settlement of industrial relation disputes.

- Employer shall be prohibited from discontinuing working relations with the following reasons:

- The worker is absent from work because he or she is taken ill as attested by a written statement from the physician who treats him or her provided that he or she is not absent from work for a period of longer than 12 (twelve) months consecutively.

- The worker is absent from work because he or she is fulfilling his or her obligations to the State in accordance with what is prescribed in the valid statutory legislation.

- The worker is absent from work because he or she is practicing what is required by his or her religion.

- The worker is absent from work because he or she is getting married.

- The worker is absent from work because she is pregnant, giving birth to a baby, having a miscarriage, or breast-feeding her baby.

- The worker is related by blood [birth] and or through marriage to another worker in the enterprise unless so required in the collective work agreement or the enterprise’s rules and regulations.

- The worker establishes, becomes a member of and or an administrator/ official of a trade/labour union; the worker carries out trade/labour union activities outside working hours, or during working hours with permission by the entrepreneur, or according to that which has been stipulated in the individual work agreement, or the enterprise’s rules and regulations, or the collective work agreement.

- The worker reports to the authorities the crime committed by the entrepreneur.

- Because the worker is of different understanding/ belief, religion, political orientation, ethnicity, color, race, sex, physical condition or marital status.

- Because the worker is permanently disabled, ill as a result of a work accident, or ill because of an occupational disease [literal translation: employment relationship] whose period of 40 recovery cannot be ascertained as attested by the written statement made by the physician who treats him or her.

- The decision of the institute for the settlement of industrial relation disputes is not needed if:

- The affected worker is still on probation provided that such has been stipulated in writing beforehand.

- The affected worker makes a written request for resignation at his/her own will with no indication of being pressurized or intimidated by the entrepreneur to do so; or the employment relationship comes to an end according to the work agreement for a specified period of time for the first time.

- The affected worker has reached a retirement age as stipulated under work agreements, enterprise rules and regulations, collective work agreements, or laws and regulations.

- The affected worker dies.

FAQs ON LAND OWNERSHIP

The investors can buy and own land in Indonesia for a certain period of time using the following rights:

- The Right of Exploitation (Hak Guna Usaha or HGU) is granted for a maximum of 25 years and can be extended for another 25 years. For company that requires a longer period, an HGU for a maximum of 35 years may be granted.

- The Right of Building (Hak Guna Bangunan or HGB) is the right to build and to own a building on land which does not belong to someone’s property for a period of no more than 30 years and can be extended for a maximum of 20 years.

- The Right of Use (Hak Pakai) is the right to use and/or to collect the product, from land directly controlled by the state, or land owned by other persons which gives the rights and obligations stipulated in the decision upon granting his right by the authorized official, or in the agreement to utilize the land, as far as it is not conflicted with the spirit and the provision of the law.

The HGU, HGB, and Hak Pakai can be owned by Indonesian citizens, foreigners residing in Indonesia, corporate bodies established under Indonesian Law and are based/having offices in Indonesia, and foreign companies that have a representative office in Indonesia.

The HGU and HGB ownerships are allowed to change during the contract period. However, Hak Pakai can only be transferred to other parties with the approval of the relevant government official. Hak Pakai owned by an individual can also change hands.

Yes, it depends on the type of the property:

- For a landed building (house, office, factory), it is only allowed for a foreign or FDI Company (PT.PMA) and the status of the land is HGB or Hak Pakai. Regarding the ownership of a landed house, it is regulated on Government Regulation No. 103 Year 2015 on House Ownership of Foreigners Residing in Indonesia.

This regulation allows foreigners to buy a landed house under the Right of Use category for a period up to 80 years (an initial period of 30 years and can be extended twice by 20 years and a further 30 years). - For a condominium or apartment and office space, the foreigner or PT. PMA can own it as long as it is not a part of a governmentsubsidized housing and the land status of the building is strata title status under the Right of Use. Still based on the same regulation, regarding apartments, foreigners are allowed to purchase an apartment under the Right of Use category, and this is valid for luxurious apartments priced over IDR 10 billion.

- The title of the plantation land is The Right of Exploitation (HGU) for agricultural, fishery or animal husbandry purposes. You may buy and own the land, but the status of the land is state-owned land and the HGU is only valid for certain period of time.

- The type of plantation crops must be in accordance with the HGU. This right can be held by Indonesian individuals or entities as well as government approved FDI companies (PT. PMA/ foreign joint venture) and can be pawned.

FDI companies that are property developers can buy land in Indonesia to develop property. The status of the land is the Building Right (HGB) which will be divided into small lots accordingly. Then, the property buyer can submit an application to change the status of the land to Ownership Rights (Hak Milik) which is only allowed for Indonesian citizens.

FAQs ON TAXATION

The basic tax obligation is Income Tax (Pajak Penghasilan or PPh) which is progressive and applied to both individual and corporate. FDI companies that are located and conducted business activities in Indonesia, and foreigners who work and earn income in Indonesia generally must bear the same tax obligations as the resident tax payers. The self-assessment method is used to calculate income tax. Tax rates for individual and corporate are described in the following tables:

The Tax Withholding system is used in Indonesia to collect the income tax. If a certain item of income is subject to withholding tax, the payer is responsible for holding or collecting taxes. For example, employers are required to withhold income tax of the salaries paid to their employees and pay the tax to the tax office on their behalf.

Note: Detailed information on Income Tax should refer to Law of the Republic Indonesia No. 36 Year 2008 regarding Income Tax.

Land & Building Tax (Pajak Bumi dan Bangunan or PBB) The owners of land & buildings have to pay tax annually on land, buildings and permanent structures. The effective rates are nominal, typically not more than one tenth of one percent per year (0.1%) of the asset value.

Value Added Tax or VAT

In normal cases, 10% VAT is applied to imports, manufactured goods and most services. However, in accordance with the Government Regulation No. 81 Year 2015, the strategic certain Taxable Goods whose importation and/ or delivery is exempted from VAT are now as follows:

- Plant machinery and equipment which is used directly in the process of generating taxable goods, excluding spare parts, and shall use a VAT Exemption Certificate;

- Goods resulting from business activities in the maritime and fishery sector, both capture fishery and aquaculture;

- Raw hides and skins that are not tanned;

- Certain livestock;

- Certain seeds and/or breeding stock of goods of agriculture, plantations, forestry, livestock, or fishery;

- Animal feed,excluding pet food;

- Fish feed;

- Feed material for the manufacture of livestockfeed and fish feed;

- Raw material of silverhandicrafts; and

- Owned Simple Flat (“Rumah Susun Sederhana Milik”)units with changed criteria such as limits on selling price and income of the individual purchasing the unit as regulated by Ministry of Finance (previously maximum selling price was IDR 144,000,000 and maximum income was IDR 4,500,000 per month and owner must haveTax ID number);

- Electricity, except for houses with power above 6,600 (six thousand six hundred) Volt-Amperes

Sales Tax on Luxury Goods (Pajak Penjualan atas Barang Mewah or PPnBM)

These tax ranges from 10% to 75%. The list of the tax should be referred to The Government Regulation No. 12 Year 2001 jo. No. 43 Year 2002 jo. No. 46 Year 2003 and other related tax implementation regulations.

Stamp Duty

The stamp duties nominal is either IDR 3,000 or IDR 6,000 on certain documents. The rate of IDR 6,000 is applicable for letters of agreement and other letters, such as Notary Deed and Land Deed including its copies. For all documents bearing a sum of money, therate is IDR 6,000 when the value stated in the document is more than IDR 1 million, and IDR 3,000 when the value is between IDR 500,000 and IDR 1 million. Below IDR 500,000 is not subject to stamp duty. For cheques, the rate is IDR 3,000 regardless of money value stated.

Deemed Withholding Tax

Applicable for Trade Representative Office in Indonesia. Decree of Directorate General of Taxation, KEP-667/PJ./2001, states that deemed withholding tax for Trade Representative Office must be paid at the rate of 0.44% out of 1% gross export value.

This is only applicable to foreign taxpayers who have no double-tax treaty agreement. For more information of the payment details, please refer to Directorate General of Taxation Circular No. SE-2/PJ.03/2008.

Note: Beside tax, local government in the provinces or cities usually apply retribution for some business sectors and it varies from region to region.

FAQs ON IMMIGRATION

Yes, foreigners who will travel to Indonesia should apply for a visa from the Indonesian Embassy in their respective countries unless they come from one of the visa-exempt countries, or the countries that qualify for Visa on Arrival or VoA (Visa Kunjungan Saat Kedatangan).

All visitors must hold a passport valid for 6 months from the date of arrival and have a valid return ticket. The immigration entrance officer at the port may ask the passenger to show any necessary documents (such as hotel reservation and other financial evidences).

Regarding the purpose of visit, ASEAN Countries Nationality Visitors are able to visit Indonesia without any visa for the purpose of official duties, education, tourism, business, government and social culture purpose. They may stay up to 30 days without renewal or convert to other types of visas.

Based on Presidential Regulation No. 21 Year 2016 regarding Visa-Free Visit, 169 recipient countries can visit Indonesia without visa, with a stay permit for 30 days and cannot be extended.

Based on Regulation of Minister of Law and Human Rights No. 39 Year 2015, nationals from 71 countries may apply for a VoA for 30-day length of stay by paying a certain amount of money. The fee is the same for any passenger of any age, including infants. This VoA can be extended for other 30 days once. Nationals who are not eligible for Visa-Free Visits or VoA should apply for a visa at Indonesian Embassy/ Consulates.

As for nationals from 9 following countries require an approval from Immigration Office in Indonesia before travelling for business, tourist and social visits purposes:

- Afghanistan

- Cameroon

- Guinea

- Israel

- Liberia

- Niger

- Nigeria

- North Korea

- Somalia

All the applicants for any types of visa must comply with the general requirements below:

- Provide a complete and signed visa application form. The application form is available in the Embassy, or could be downloaded from the website of respective embassy of intended application.

- The actual passport and a copy.

- The passport must have at least 2 blank pages left for the use of visa sticker and stamps. For a single entry visa, the passport must be valid for at least 6 months after the date of entry, and for the multiple business visa and Limited Stay Visa (VITAS), it must be valid for at least 18 months after the date of entry.

- A guarantee of the available funds to cover living expenses while in Indonesia (e.g. the last 3-month bank statement or a traveller’s cheque).

- 2 (two) photos (with colour background, passport size).

- The applicants are not in the immigration’s alert list, and have to come in person.

Note:

- The Embassy has the authority to reject any applicants.

- Additional documents might be required, depending on the purpose of stay.

In regards to visa application fees, the currency fluctuation of visa fees are adjusted accordingly to each country’s currency. For this reason, each visa applicant is advised to contact directly to the Indonesian Embassy or Consulates located in the respective country. In the case where Indonesian Government representative is not available at the applicant resident city or area, please contact Ministry of Foreign Affairs of the Republic of Indonesia at the following link: www.kemlu.go.id.

The applicant can apply online by going to Visa Section on the website www. imigrasi.go.id, or come directly to Directorate General of Immigration. Any foreigners intending to work and stay in Indonesia must get Limited Stay Visa (VITAS). Further information about VITAS can be found in the answer for question no. 30.

Yes, you can bring your family to Indonesia. They should get Limited Stay Visa (VITAS) and Limited Stay Permit Card (KITAS) by following the same procedures as mentioned above.

Yes, there is visa facilitation scheme applicable for investor in the Special Economic Zone or SEZ (KEK). Currently, Head of Integrated Investment Service Unit (Kepala Pelayanan Terpadu Satu Pintu or PTSP), which has been designated by the Director General of Immigration to implement the licensing authority in the provision of facilities for licenses and investment to investors who are in an SEZ which cover certain areas in Batam, Bintan and Karimun in Riau Islands.

Immigration officials can grant approval of Limited Stay Visa (Visa Tinggal Terbatas or VITAS)to foreigners who live in the SEZ for people coming as:

- Investors

- Working as an expert

- Spouse of Limited Stay Permit holders

- Parents of child under 18 years old

- Foreign home owner and/or elderly in accordance with existing regulation.

Officials at the Indonesian Embassy/ Consulates can grant a Limited Stay Visa (VITAS) for 2 years for investors after receiving approval from the immigration officer at PTSP in SEZ.

In the framework of assessment or business development in the SEZ, Indonesian Embassy/Consulates are allowed to provide a Multiple-Trip Visa which is applicable for 1 year for foreigners with a period of stay of 60 days.

In regards to provision of short-term work for the development of SEZs, foreigners with access to Visa-Free Temporary Visit (Bebas Visa Kunjungan Singkat or BVKS) can be given VOA for a period of 7 days. Limited Stay Visa (VITAS) Requirements (for SEZ area):

- A request from the company or sponsor

- Completed application and guarantee form

- Company or sponsor profiles.

- Foreign Workers Utilization Plan (RPTKA)

- CV or resume of applicant

- Copy of passport

- Photo 4x6 cm (2 copies)

Multiple Visit Visa Requirements (for SEZ area):

- Application from the company

- Completed application and guarantee form

- Company or sponsor profiles

- CV or resume of applicant

- Copy of passport

- Photo 4x6 cm (2 copies)

FAQs ON TRADE

There are 2 ways to export product to Indonesia:

Appointing a local company in Indonesia as your agent or distributor.

- A local distributor company will fulfilll all requirements to import your products. If the products are related to food and drugs, it should be registered to the National Agency of Drug and Food Control (BPOM) [www.pom.go.id]. However, the ownership right of product registration can only be obtained by the local distributor company. Therefore, there might be a risk, such as the ownership right of product registration may cause conflicting issues on the possession of the rightful owner of the market trademark.

- Establishing your own company as the Trading (import/ export/ distributor) Company. Through this scheme, your company can apply the ownership right of your own products. If your trading company is just importing, your company is not allowed to distribute the products, hence you still have to appoint a local distributor or agent company.

In both ways, the company should obtain an NIB via OSS website, www. oss.go.id.

There are restrictions and limitations to export and import some specified products and commodities. Please refer to the website of Indonesia National Single Window (INSW) as follows, http://eservice.insw.go.id

You also may check directly to the website of INSW as mentioned in the previous question.

In a general and simplified explanation, the steps of custom clearances for imported products are as follows:

- Importer is required to submit Notification of Imported Goods (Pemberitahuan Import Barang/ PIB) to the custom office.

- Importer proceeds to pay for custom duties and import tax at the bank.

- Process custom clearance by submitting:

- Proof of custom duties and import tax payment.

- NIB which is the ratification of Importer Identification Number (API) and custom access rights (Customs Registration Number-NIK)

- Taxpayer identification number (NPWP)

- Notification of Imported Goods (PIB)

- Tax and Custom Deposit Letter

- Invoice

- Packing list

- Bill of Lading (Dokumen Pengangkatan Barang atau B/L)

- Insurance document Once the custom is cleared, importer will be issued Customs Clearance Approval Certificate (Surat Perintah Pengeluaran Barang/SPPB).

Importer will be able to release the goods from custom by enclosing:

- Delivery order from shipping agency

- SPPB

Information on Import Duty rate can be found at the following link: http://www.beacukai.go.id/btki.html

The rate information requires the importer to identify the exact Harmonized System (HS) Codes for their imported products. HS Codes can be found on Indonesia National Single Window (INSW) website, as mentioned in the previous question.

Indonesian Import-Export Prohibition and Restriction Regulations (Larangan dan/ atau Pembatasan Ekspor-Impor or LARTAS) maintain the full details of products restricted from import and export activities. LARTAS information can be found on Indonesia National Single Window (INSW) website, as mentioned in the previous question.

All food and drug products such as drug, traditional medicine, cosmetics, food supplement and processed food, must fulfill all safety requirements to enter the Indonesian market. This imported food and drug registration is regulated under Indonesian National Agency of Drug and Food Control (BPOM), one of the provisions is the Regulation of the Head of the Agency of Drug and Food Control Republic of Indonesia No. 30 Year 2017 concerning Importation Control of Drug and Food into the Territory of Indonesia.

The registration must be done by the local company, local agent or distributor before the products get cleared to Indonesian customs. To import drug and food, the importer must apply Letter of Import (Surat Keterangan Impor or SKI) to the Head of BPOM. The procedure to obtain SKI Border and Post Border are as follows:

- Register online on BPOM website, http://www.pom.go.id, http:// www.e-bpom.pom.go.id or Indonesia National Single Window (INSW) website, http://eservice. insw.go.id with the Single Sign On mechanism.

- Upload following supporting original documents to one of both websites above to get the username and password:

- Letter of application signed by the directors or the power of attorney of directors with stamp of duty

- Letter of responsibility with stamp of duty

- NIB which functions as Importer Identification Number (API)

- Trading Business License (Surat Izin Usaha Perdagangan/SIUP)

- Taxpayer Identification Number (NPWP)

- Power of attorney regarding importing in the form of Certificate by a notary, in terms of the applicant is a company who has been authorized to import G. List of HS code of product to import

- For the SKI Border of drug, the applicant should attach Pharmaceutical industry license.

- Do the e-payment as one of NonTax Revenue (Penerimaan Negara Bukan Pajak or PNBP).

- Submit the electronic documents such as:

- Distribution approval license

- Certificate of analysis C. Invoice.

- Additional documents or tests might be required depending on the product category

FAQs ON RELATED GOVERNMENT AGENCIES

Following is the list of Government Agencies and other Institutions relevant to investments in Indonesia

Indonesia Investment Coordinating Board (Badan Koordinasi Penanaman Modal/BKPM)

Jalan Jend. Gatot Subroto Kav 44, Jakarta Selatan, DKI Jakarta 12190

Tel : +6221 525 2008

Contact Center OSS : +62807 100 2576

Email : info@bkpm.go.id

Website : www.bkpm.go.id, www.investindonesia.go.id

Ministry of Environment and Forestry of the Republic of Indonesia (Kementerian Lingkungan Hidup dan Kehutanan RI)

Jalan Jenderal Gatot Subroto No 2, Jakarta Selatan, DKI Jakarta 10270

Tel : +6221 570 4501, +6221 570 4504, +6221 573 0191

Website : www.menlhk.go.id

Ministry of Trade of the Republic of Indonesia (Kementerian Perdagangan RI)

Jalan M.I. Ridwan Rais No. 5, Jakarta Pusat, DKI Jakarta 10110

Tel : +6221 385 8171

Email : contact.us@kemendag.go.id

Website : www.kemendag.go.id

Ministry of Industry of the Republic of Indonesia (Kementerian Perindustrian RI)

Jalan Jenderal Gatot Subroto Kav. 52-53, Jakarta Selatan, DKI Jakarta 12950

Tel : +6221 525 5509, extention. 2737,

Fax : +6221 525 5609

Website : www.kemenperin.go.id

Ministry of Finance of the Republic of Indonesia (Kementerian Keuangan RI)

Jalan Dr. Wahidin Raya No. 1, Jakarta Pusat, DKI Jakarta 10710

Tel : +6221 386 1489,

Fax : +6221 350 0842, +6221 350 0847

Website : www.kemenkeu.go.id

Ministry of Public Works and Public Housing of the Republic of Indonesia (Kementerian Pekerjaan Umum dan Perumahan Rakyat RI)

Jalan Pattimura No. 20, Jakarta Selatan, DKI Jakarta 12110

Tel : +6221 722 8497

Website : www.pu.go.id

Ministry of Marine and Fishery of the Republic of Indonesia (Kementerian Kelautan dan Perikanan RI)

Jalan Medan Merdeka Timur No. 16, Jakarta Pusat, DKI Jakarta 10710

Tel : +6221 351 9070,

Fax : +6221 386 4293

Website : www.kkp.go.id

Ministry of Agriculture of the Republic of Indonesia (Kementerian Pertanian RI)

Jalan Harsono RM No. 3, Jakarta Selatan, DKI Jakarta 12560

Tel : +6221 780 6131, +6221 780 4116, Fax: +6221 780 6305

Email : webmaster@pertanian.go.id

Website : www.pertanian.go.id

Ministry of Tourism and Creative Economy of the Republic of Indonesia (Kementerian Pariwisata dan Ekonomi Kreatif RI)

Jalan Medan Merdeka Barat No. 17, Jakarta Pusat, DKI Jakarta 10110

Tel : +6221 383 8167, +6221 383 8899,

Fax : +6221 384 9715

Website : www.kemenpar.go.id

Ministry of Health of the Republic of Indonesia (Kementerian Kesehatan RI)

Jalan HR. Rasuna Said Blok X5 Kav. 4-9, Jakarta Selatan, DKI Jakarta 12950

Tel : +6221 520 1591,

Fax : +6221 5292 1669

Email : kontak@kemekes.go.id

Website : www.kemkes.go.id

Ministry of Communication and Information of the Republic of Indonesia (Kementerian Komunikasi dan Informasi RI)

Jalan Medan Merdeka Barat No. 9, Jakarta Pusat, DKI Jakarta 10110

Tel : +6221 345 2841

Email : humas@mail.kominfo.go.id

Website : www.kominfo.go.id

Ministry of Transportation of the Republic of Indonesia (Kementerian Perhubungan RI)

Jalan Medan Merdeka Barat No. 8, Jakarta Pusat, DKI Jakarta 10110

Tel : +6221 381 1308, +6221 350 5006

Email : info151@dephub.go.id

Website : www.dephub.go.id

Ministry of Energy and Mineral Resources of the Republic of Indonesia (Kementerian Energi dan Sumber Daya Mineral RI)

Jalan Medan Merdeka Selatan No. 18, Jakarta Pusat, DKI Jakarta 10110

Tel : +6221 380 4242,

Fax : +6221 344 0649

Email : puskom@esdm.go.id

Website : www.esdm.go.id

Ministry of Agrarian and Spatial Planning of the Republic of Indonesia (Kementerian Agraria dan Tata Ruang RI)

Jalan Sisingamaraja No. 2, Jakarta Selatan, DKI Jakarta 12110

Tel : +6221 739 3939

Email : humas@bpn.go.id

Website : www.bpn.go.id

Ministry of Law and Human Rights of the Republic of Indonesia (Kementerian Hukum dan HAM RI)

Jalan H.R. Rasuna Said Kav. 6-7, Jakarta Selatan, DKI Jakarta 12940

Tel : +6221 525 3004

Website : www.kemenkumham.go.id

Ministry of Manpower of the Republic of Indonesia (Kementerian Ketenagakerjaan RI)

Jalan Jenderal Gatot Subroto Kav. 51, Jakarta Selatan, DKI Jakarta 12950

Tel : +6221 525 9285, +6221 797 4488

Website : www.naker.go.id

Ministry of Education and Culture of the Republic of Indonesia (Kementerian Pendidikan dan Kebudayaan RI)

Jalan Jenderal Sudirman, Jakarta Pusat, DKI Jakarta 10270

Tel : +6221 570 3303, +6221 570 3303

Email : pengaduan@kemdikbud.go.id

Website : www.kemdikbud.go.id

Ministry of Defense of the Republic of Indonesia (Kementerian Pertahanan RI)

Jalan Medan Merdeka Barat No. 13-14, Jakarta Pusat, DKI Jakarta 10110

Tel : +6221 384 0889

Email : ppid@kemhan.go.id

Website : www.kemhan.go.id

Sponsors and Partners